Startup Funding: The Founder's Definitive Roadmap to Raising Capital and Optimizing the Capital Stack

In the hyper-competitive world of startup funding, a great idea is merely the price of entry. Founders today must possess strategic foresight to navigate a vast and complex landscape of capital, ensuring every dollar raised aligns with their growth model and long-term vision.

From pre-seed capital to late-stage Series B and beyond, knowing what kind of funding to raise, when to raise it, and how it impacts long-term control is the single most critical skill for building a sustainable, scalable business.

This comprehensive, executive-level guide will equip you with the knowledge to:

- Master the Startup Funding Stages and their corresponding instruments.

- Analyze the Core Trade-Off: Equity vs. Debt vs. Hybrid structures.

- Optimize Your Capital Stack: The strategic mix of funding for efficiency.

- Execute a Flawless Fundraise: Valuation methods, pitch preparation, and due diligence.

The Four Stages of Startup Funding: A Strategic Framework

Startup funding is a non-linear journey organized into distinct phases, each defined by the company's traction, risk profile, and primary capital need.

Secure your next funding – without giving up equity

Get up to €5M in non-dilutive funding with re:cap. Calculate your funding terms and see how much growth capital you could get.

Calculate funding terms2. Equity-Based Institutional Funding

This is the engine of high-growth technology startups. 2022, VCs worldwide invested more than $500 billion in startups, early-stage and growth companies.

- Business Angels (Pre-Seed/Seed): Typically invest €10K - €500K. They offer crucial experience, mentorship, and network access – often more valuable than the cash itself.

- Venture Capital (VC): The primary source of capital for the Growth Stage (Series A, B, C).

- VC Expectation: Target 10x to 30x return on investment within 5-10 years. This intense pressure dictates the company's speed and strategy.

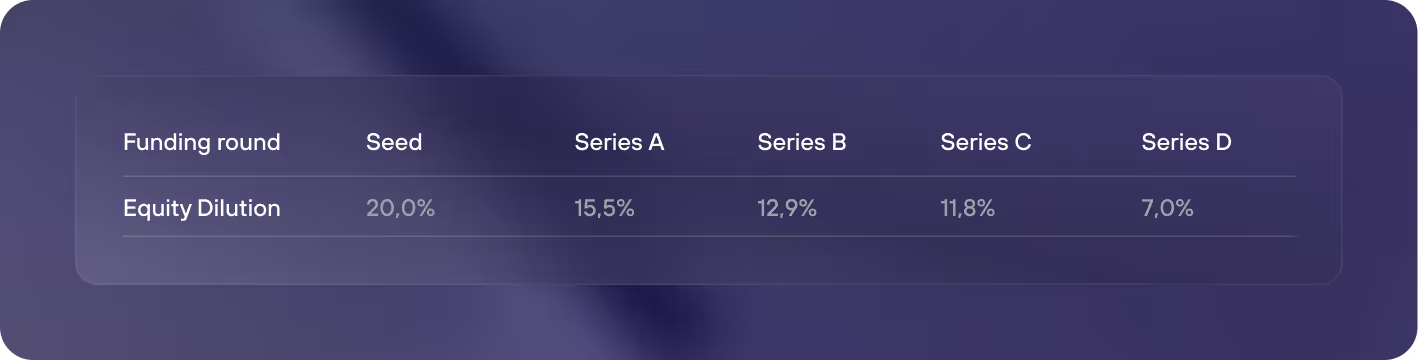

- The Dilution Ladder: Founders typically lose 20%-30% ownership in each VC round. By Series B, original founders may own less than 50% of the company.

Secure your next funding – without giving up equity

Get up to €5M in non-dilutive funding with re:cap. Calculate your funding terms and see how much growth capital you could get.

Calculate funding termsFAQs

Didn’t find an answer? Talk to us.

How do SaaS companies work?

SaaS stands for Software-as-a-Service and refers to a licensing and distribution model by which companies offer software solutions online as a service.

What growth stages do SaaS companies go through?

After the preparatory early-stage phase, the product goes live, becomes better known, and establishes itself in the market, before the customer base ideally expands significantly and finally either a company sale, a merger, or further growth takes place.

Why is revenue financing ideal for SaaS companies?

In the important second growth phase, when SaaS companies are already on the market and generating recurring revenue, revenue financing provides flexible SaaS funding based on the ARR without dilution or loss of control.

What is ARR?

ARR refers to annual recurring revenue. Specifically, in the subscription economy, ARR refers to the annual value of regular revenue generated through subscriptions.

What does ACV mean?

ACV stands for Annual Contract Value and in a SaaS business, it refers to the average annual value of a subscription - i.e., the holistic contract value excluding one-time fees divided by the contract term in years.

FAQs

Didn’t find an answer? Talk to us.

What is a corporate loan?

As a counterpart to the personal loan, the corporate loan serves entrepreneurial purposes - as a short-term cash injection for liquidity needs or as an investment for long-term growth. Entrepreneurs use the borrowed capital, for example, for new personnel, a larger office, marketing, better hardware, or the company's establishment.

What kind of business loans are there?

A short-term business loan runs for a few months or years, while a long-term loan runs for several years. If a company needs capital quickly, an overdraft is an excellent short-term loan financing option - there are not many conditions to be met for this, as the principle is similar to an overdraft.

What are the providers of business loans?

There are many providers of business loans. Three overriding types come into focus:

- via the principal bank

- state-subsidized

- digital solutions

The first way is via the branch banks. The options are diverse, whether long-term or short-term credit, investment or working capital credit, just like the linked conditions. Subsidized corporate loans are also run through the house bank, but regional or nationwide development banks (such as KfW) are involved here.

Modern solutions come from FinTechs that specialize in smart financing. Whether credit or alternative, this is where startups and large companies meet technology-savvy innovators of the digital age.

What is the advantage of corporate loans?

A corporate loan is usually available quickly. In addition, because it is debt financing, founders do not have to give up control as well as company shares and do not have to share profits with lenders.

What is the disadvantage of business loans?

Business loans come with interest and are often tied to a specific purpose, so entrepreneurs are limited in how they can use the capital. It is also usually a restrictive concept with strict repayment terms, warrants, and very little flexibility - which is why many companies are looking for a suitable loan alternative.

How do credit and loans differ?

Some refer to short-term financial assistance and a smaller amount as a loan and to longer terms and higher capital as a loan. However, the terms are usually used interchangeably.

What are the interest rates on corporate loans?

They can be less than 1% or in the double digits. The credit rating determines this: the higher the risk class, the higher the interest rates. The amount of capital, term and any collateral also determine the interest rate. Therefore, it is always a good idea to compare different corporate loans.

Who grants corporate loans?

Companies can obtain the traditional loan from their principal bank - a government subsidy via federal or regional development banks is also possible. Modern variants come from FinTechs, which use technology-driven solutions for smart financing.

What are the alternatives to corporate loans?

Various financing solutions work with equity and debt. With equity financing such as venture capital, founders lose valuable company shares and often have to give a say. A particularly smart alternative to corporate loans and equity financing is non-dilutive, non-restrictive and very flexible turnover financing.

What is the best credit alternative?

There is no all-comprising answer to this question, as financing is always an individual solution. However, recurring revenue financing is increasingly establishing itself as a particularly attractive and popular alternative to loans and equity financing.

What makes re:cap stand out as an alternative to loans?

With re:cap, SaaS companies can obtain growth capital very easily and quickly - up to 50% of ARR. The innovative funding works with planned revenues and also flexibly aligns repayments accordingly. In addition to on-demand financing, re:cap offers valuable insights and benchmarks on request.

FAQs

Didn’t find an answer? Talk to us.

What does debt financing mean?

In debt financing, companies receive a certain amount of money from an external investor. The company holds the debt capital for a limited period and must be repaid - usually with interest and within a fixed time duration.

What does debt capital include?

Debt capital includes typical liabilities of a company, such as loans, bonds, and provisions, as well as unique forms like deferred income.

What are examples of debt financing?

There are various types of debt financing, which can basically be divided into short-term and long-term debt. Unique and mixed forms are also possible - examples:

- Short-term: overdraft, trade credit, acceptance credit

- Long-term: promissory note loans, bonds, long-term bank loans

- Special form: leasing, factoring, asset-backed securities

- Mixed form: mezzanine as a mix of equity and debt financing

What is short-term debt capital?

Short-term debt capital is provided to companies for a short period of time - repayment usually takes place within a few months. Such capital is primarily used to meet short-term liquidity needs.

What is long-term debt?

Long-term debt capital is provided to companies for a longer period of time - repayment usually occurs within several years. The capital is used for investments.

What is the difference between equity and debt financing?

From the perspective of the capital providers, it is primarily a question of liability because, in the case of equity financing, capital providers are liable for entrepreneurial activities. In return, they usually receive a share and benefit directly from the profits. Because founders relinquish shares and entrepreneurial control, this is referred to as a dilutive type of financing. This is not the case with debt financing, which involves interest and is generally more restrictive.

FAQs

Didn’t find an answer? Talk to us.

How can I finance my startup?

From bank loans to private savings to equity financing: There are many ways to finance a startup - through external providers and your own capital. As a novel and popular solution, so-called revenue financing is also becoming more and more established in Germany.

Which companies fund startups?

In addition to investment companies from the venture capital segment, there are innovative FinTech companies such as re:cap. They innovate to create modern funding solutions. re:cap enables companies in the subscription economy to trade future revenues for on-demand, non-dilutive capital. Fast, transparent and easy.

Who is startup funding with re:cap suitable for?

The funding solution from re:cap is specifically aimed at subscription companies that reach a growing customer base with their already launched product and generate predictable, recurring revenues. In addition, the legal entity must be at least partially located in the EU.

How quickly can I get startup funding?

As long as you are within your financing limit, you can access new funds as often as you like. The financing limit will be increased based on the growth of your business and the track record on the re:cap platform.

The funding will typically arrive in your bank accounts within two business days once it gets approved.

FAQs

Didn’t find an answer? Talk to us.

What is working capital?

Working capital is also called operating working capital. It is the difference between current assets and current liabilities and, as a balance sheet ratio, provides information on companies' capital stock and financial strength.

What does working capital tell us?

The working capital figure shows which funds are tied up in regular company operations - it can also be used to determine whether working capital financing is necessary.

Is high working capital good or bad?

A positive value shows that current assets can cover current liabilities - this is important in terms of the golden rule of the balance sheet. A negative value conveys a risk, because affected companies are considered to be illiquid. This can lead to financial bottlenecks.

Can working capital be too high?

The question of working capital levels is answered differently depending on the company or business model - especially across industries. However, working capital levels that are too high often indicate that working capital is being used less wisely and that too much cash is being tied up.

What are examples of working capital?

In business management, working capital is usually indirect and long-term goods that companies need for their products and services. A distinction is made between tangible resources, such as warehouse and office space, and intangible ones, such as licenses.

How does working capital financing work?

Working capital financing allows companies to increase their working capital and generate positive value. It provides them with short-term cash to pay liabilities or make investments.

What are the different working capital options?

Working capital financing is multifaceted. Depending on the industry and business model, various types may therefore be considered, such as drawing on the credit line, receivables credit, factoring, and inventory lending. Increasingly popular are alternative solutions such as non-dilutive and non-restrictive sales-based financing.

FAQs

Didn’t find an answer? Talk to us.

What is a convertible loan?

The definition of a convertible loan is simple: it is a normal loan in which the company does not repay the borrowed amount after the expiration of the term, but converts it into company shares. It is therefore technically a combination of both equity and debt.

How does a convertible loan work?

The following scenario is a typical example of a convertible loan: A company receives capital with a predefined interest rate. The parties agree on a term and also a discount on the company's shares, which acts as a risk compensation. At the end of the term, the investor receives the shares in the amount of the convertible loan plus interest - so-called qualified capital for the company.

How high are convertible loans?

Usually, convertible loans are around 100,000€ - but they can also be up to 400,000€ and more. To collect as much capital as possible, start-ups often arrange several convertible loans with different investors.

What should a convertible loan agreement regulate?

In principle, there is freedom of contract here - a convertible loan agreement is therefore not subject to any legal rules. The following components are the basis: the amount of the loan, the interest rate and discount, and the term. In addition, some parties agree on a cap (maximum valuation) or a floor (minimum valuation). Subordination is also included in many convertible loan agreements.

What is an alternative to the convertible loan?

Founders can obtain convertible loans quickly and easily and use them flexibly. These advantages also characterize re:cap's convertible financing. However, convertible financing involves giving away shares. This is not the case with re:cap's solution, which is non-dilutive funding for sustainable growth. Therefore, it is an ideal alternative to the convertible loan.

FAQs

Didn’t find an answer? Talk to us.

Is crowdfunding free of charge?

No. In case of success - i.e. if your project reaches its target budget - you pay platform and transaction fees between 4 and 12 percent to the crowdfunding platform. The exact amount depends on the platform. If your campaign fails, you pay nothing.

Why is crowdfunding so popular?

Crowdfunding brings many advantages. The fact that the legal form and creditworthiness of the project do not play a role in crowdfunding certainly plays a major role in its popularity. Thus, especially creative people and artists of all kinds, as well as non-profit initiatives, can collect money for their projects. The positive marketing effects, as well as customer proximity and loyalty, also ensure the good reputation of crowdfunding.

Who is crowdfunding suitable for?

Crowdfunding originates in the artistic sector for financing various creative projects in the fields of music, film, theater, and art. Today, however, it is also used by private individuals, non-profit organizations, and companies of all kinds - whether in the startup phase or as a boost in ongoing operations.

What are the different variants of crowdfunding?

There are four types of crowdfunding, which differ primarily in the consideration:

1) In equity based crowdfunding, investors receive returns on their investments.

2) In reward based crowdfunding, the initiators provide non-cash or intangible compensation for the investment.

3) In donation based crowdfunding, investors donate their contribution.

4) In lending based crowdfunding, the investors grant private loans with a fixed interest rate to the initiators.

How do I receive crowdfunding?

Whether you are a startup or a medium-sized company: crowdfunding can theoretically be 'applied for' by anyone. However, success depends on how many investors are convinced by the project. Anyone who wants to try their hand at crowdfunding must first create a campaign on one of the common crowdfunding platforms and advertise it on their own channels.

Does crowdfunding make sense?

Crowdfunding offers particularly many advantages for private, non-profit, and creative projects - or as a supplement to public funding. In addition, crowdfunding can be particularly worthwhile for early-stage startups that have largely completed their product development and now need fresh capital for growth. Young companies that want to test their business model or product can also benefit from the communication and participation of a crowdfunding campaign - providing an indicator for other forms of financing.

Is crowdfunding proprietary or debt financing?

Crowdfunding is financing based on debt capital. The capital provided comes from a large number of investors, mostly private individuals and companies - the so-called crowd or swarm. Hence the term 'crowd financing'.

What are the alternatives to crowdfunding?

Crowdfunding is considered an alternative financing option, which is opposed by several common alternatives (or supplements). Among them are public funding, corporate credits, venture capital, or even founder competitions. Newer forms of financing, such as re:cap's recurring revenue financing, offer another alternative to crowdfunding.

FAQs

Didn’t find an answer? Talk to us.

What is factoring?

The definition of factoring is simple: to quickly receive the money from open invoices and generate liquidity, companies hire a factor who settles the outstanding payments as an advance and takes over the accounts receivable management. It is therefore a sale of receivables.

How does the selling receivables work?

The factor checks the verity of the invoice and the creditworthiness and default risk of the debtor. Then the factor pays the majority of the outstanding invoice amount to the contracting company, usually within 48 hours. After the factor has collected the receivable from the debtor, the company receives the remaining gross amount that the factor has retained as security.

What types of factoring are there?

Anyone interested in factoring should take a closer look at their options because there are differences. In recourse factoring, the factor bears the full risk of default. Less secure - from the point of view of the selling company - is non-recourse, in which there is no protection against bad debts. If companies do not want their customers to know about factoring, they can choose the silent option.

What are the risks involved in factoring?

Since there is a large number of factoring companies, companies can quickly end up with a provider whose credit rating itself is weak. However, the performance of a factor is not always directly apparent. In the worst case, the assigned factor goes insolvent and the company loses a lot of money. In addition, some customers see it as a sign of mistrust if it is not the company providing the service that demands payment but a third party unknown to them - this could be circumvented by silent factoring.

What are the costs of factoring?

There is no single answer to this question because the fees are very opaque - based on various key business figures. In addition, the total costs are not only made up of a clearly defined factoring fee but of several items. Interest often accrues as well.

What are the most popular alternatives to factoring?

TexSince factoring is revenue-based financing, other revenue financing options are also great alternatives to factoring. This is also true for re:cap's solution - it is tailor-made for companies with a subscription business model that generate predictable, recurring revenue.t

FAQs

Didn’t find an answer? Talk to us.

What are venture capital alternatives?

Venture capital is not suitable at all times - and not for every type of company. Common alternatives are:

- Venture debt (hybrid debt financing),

- Founder competitions,

- Government subsidies

- or alternative forms of financing,such as crowdfunding.

Companies with subscription business models can also exchange their future revenues for immediately available capital - with re:cap financing.

When is venture capital worthwhile?

Generally for founders and entrepreneurs in the growth phase. But not every startup is attractive to investors. Venture capital funding is worthwhile when the business idea is innovative, the sales argument is clearly recognizable, and the founding team is convincing. In addition, the market must promise growth.

How do I get venture capital?

Private venture capitalists, also known as business angels, and so-called venture capital companies provide equity capital. But not just like that. If you want to go into fundraising, you have to be convincing. Prerequisites are a watertight pitch, a realistic understanding of the current company valuation, the amount of capital needed and the time frame in which the capital is needed.

How does venture capital work?

Venture capital is a form of private equity financing in which venture capital companies provide capital to promising unlisted companies in exchange for a stake in the company. Those who want to grow their company with venture capital must first contact investors and convince them of the company's merits.

How long does venture capital take?

Often several months pass between the start of fundraising and the receipt of venture capital. The pitch only follows after the founding team has identified potential investors. Afterward, the company is preliminarily reviewed by the potential investors. If this goes well, a term sheet is signed, followed by due diligence. The capital will flow only when the investment documentation has been completed.

If you can't or don't want to wait that long, you can look for alternative forms of financing like the one offered by re:cap. With re:cap you can bridge the time to the next round and thus, optimize the upcoming financing round. At the same time, this increases your options when looking for investors.

FAQs

Didn’t find an answer? Talk to us.

What is alternative financing?

These are forms of financing that companies can use as an alternative to established models such as loans - they are often modern solutions that are quickly and easily available digitally.

What are the different types of alternative financing?

The market for alternative financing options is growing, so companies can already choose a model that suits them individually. The better-known ones include convertible loans, factoring, crowdfunding, and venture debt. Alternative debt instruments, including recurring revenue financing or revenue-based financing, which have been successfully established in the U.S., are still rather new in Germany but becoming increasingly well-known and popular.

Need funding or cash insights?

Get the most tailored debt financing or

master your cash in real-time.

.gif)