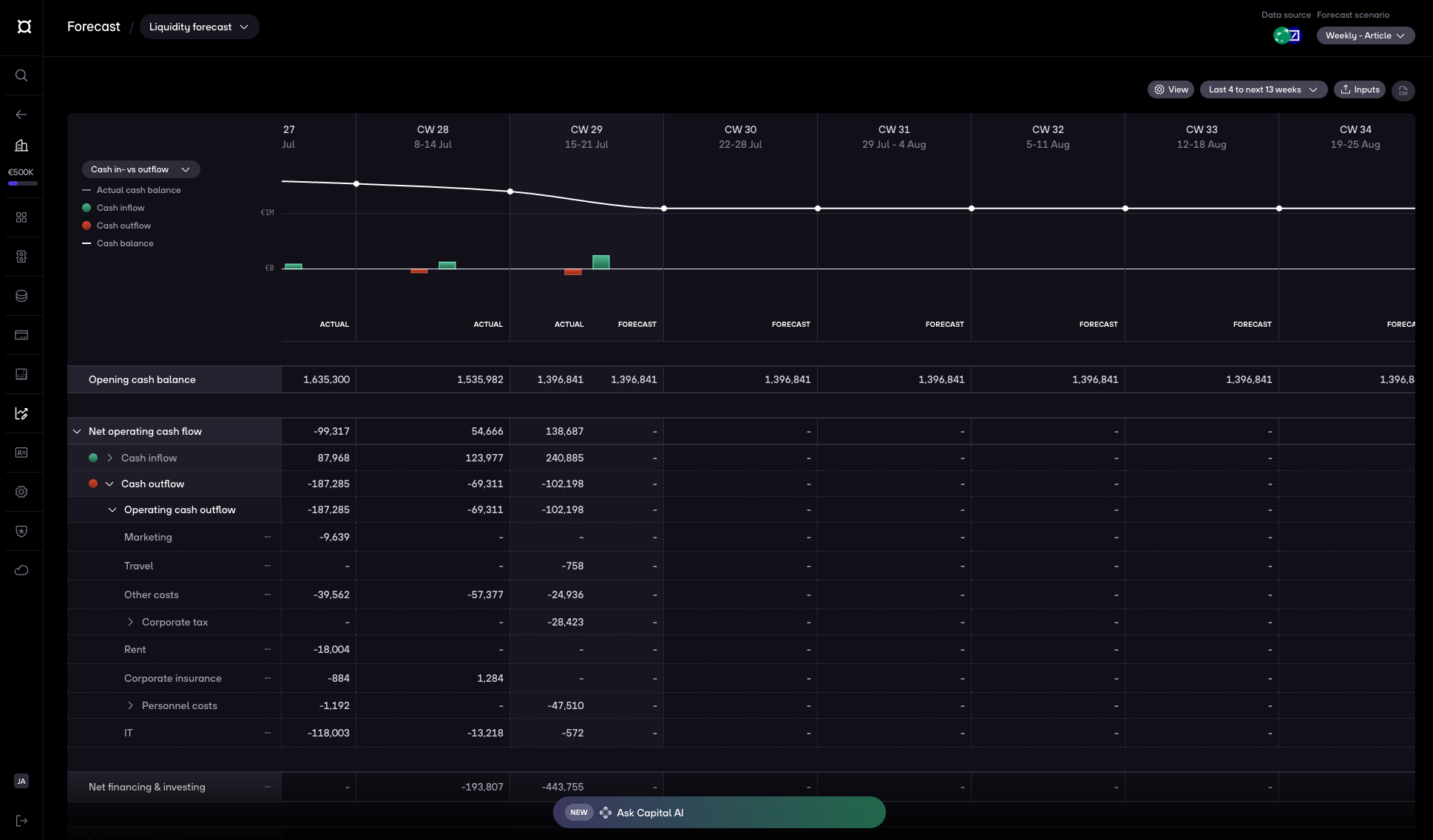

Weekly forecasts help you stay on top of upcoming cash in and cash out.

You can use them to plan and track your accounts payable (AP) and accounts receivable (AR) based on invoices and expected cash flows.

What’s shown automatically when you create a weekly forecast

Once you create a weekly forecast, re:cap automatically shows:

- A rolling view from the last 4 weeks to the next 13 weeks

- All Actuals (your bank transactions) populated up to today

- Empty Forecast columns that you can fill with invoices and optional cash flows

Add invoices

To track your AP/AR, you’ll first add your invoices to the forecast. You can do this in three ways:

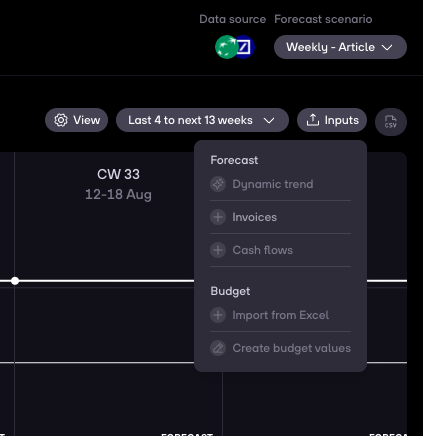

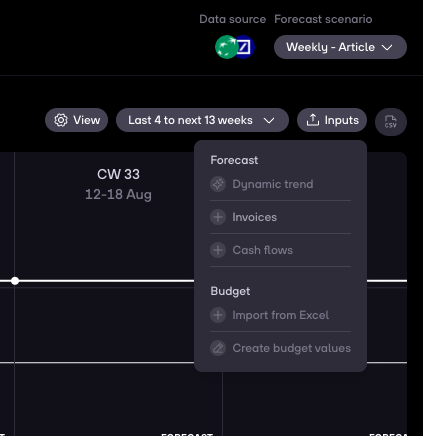

1. Option: From inputs

Klick on Inputs then click on Invoices to add invoices.

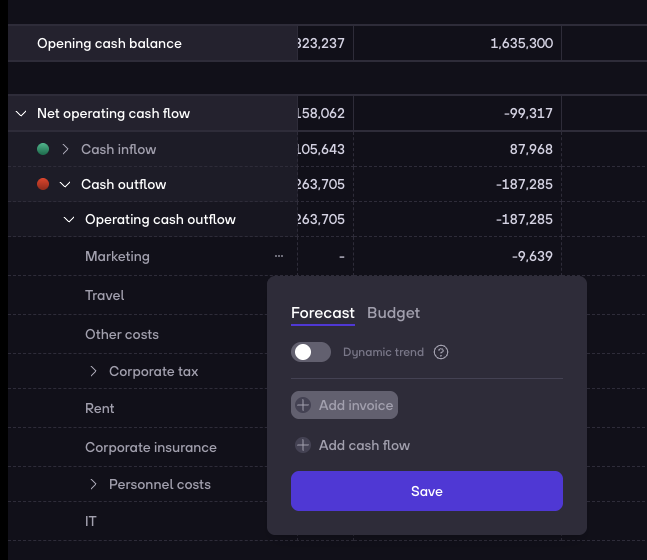

2. Option: From a specific category

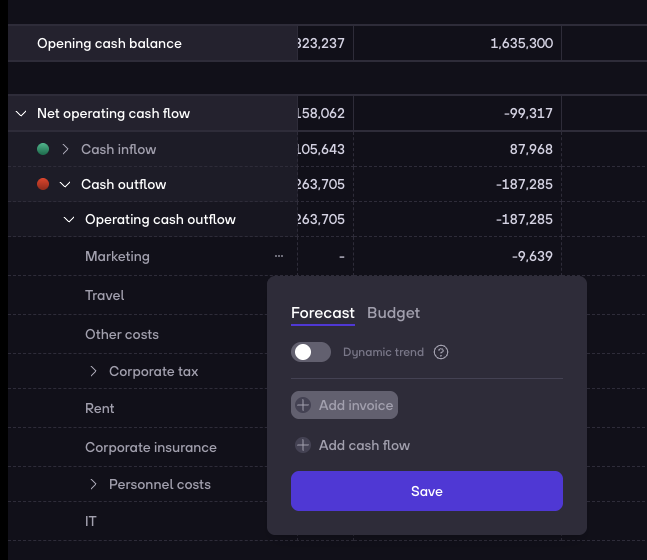

Go to a specific category. Click on ... then choose Forecast and click on Add invoice.

3. Option: Directly from the forecast

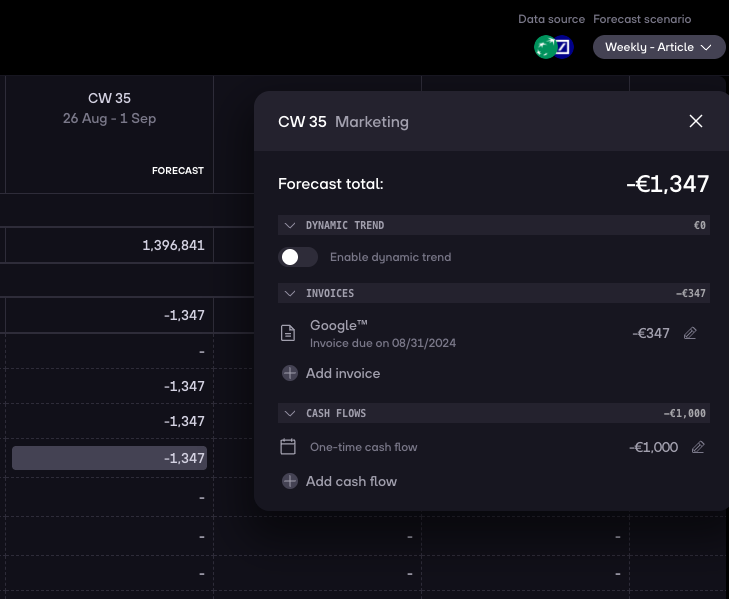

Go to a specific cell within the forecast and then click on Add invoice.

Add cash flows

On top of invoices, you can add cash flows for expected payments where you don’t have an invoice yet (for example: tax payments, expected refunds, or planned one-off costs).

Again, you have three options:

1. Option: From inputs

Klick on Inputs then click on Cash flows to add cash flows.

2. Option: From inputs

Go to a specific category. Click on ... then choose Forecast and click on Add cash flow.

3. Option: Directly from the forecast

Go to a specific cell within the forecast and then click on Add cash flow.

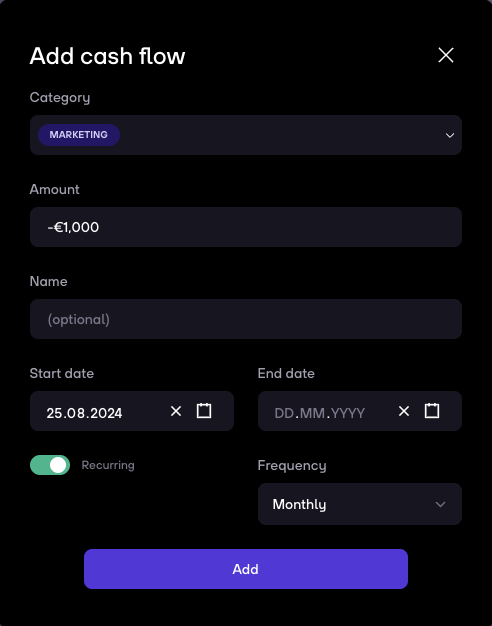

Required fields for cash flows and invoices

For all three options, the basic setup is the same:

- Amount and start date

If it’s a recurring payment (e.g. monthly rent or a subscription):

- Turn on the recurring toggle

- Define the end date (or leave it open if it’s ongoing)

- Choose the frequency (e.g. weekly, monthly)

Once you save, the amounts appear in your weekly forecast so you can immediately see their impact on your cash position.

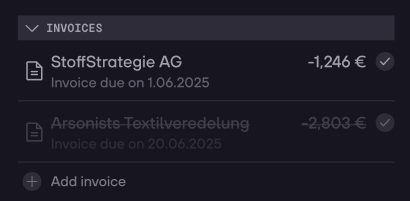

Coming soon: Manage paid or overdue invoices

You’ll be able to mark invoices and cash flows as paid by clicking a simple check mark next to them.

- Once paid, they’ll be marked as checked but still visible for transparency.

If a due date or cash flow date has passed and it’s not yet marked as paid:

- It will stay visible in the current period with a red icon until you mark it as paid.

- This helps you quickly spot overdue items.

.gif)